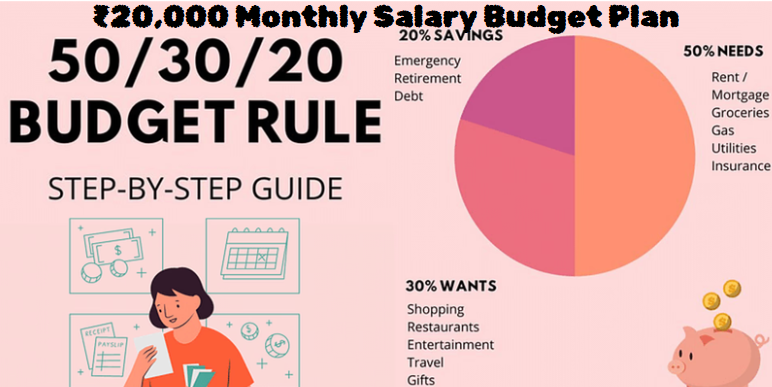

If you’re earning ₹20,000 per month, smart budgeting is essential to manage your needs, save for the future, and enjoy a decent quality of life. Here’s a practical monthly budget breakup based on your income, assuming you’re living modestly (for example, as a student, early professional, or someone living in a smaller city):

📊 Budget Breakdown of ₹20,000 Salary (50-30-20 Rule Adapted)

| Category | % | Amount (₹) | Details |

|---|---|---|---|

| 🏠 Needs (Essentials) | 50% | ₹10,000 | Rent, groceries, transport, bills |

| 🎉 Wants (Lifestyle/Leisure) | 30% | ₹6,000 | Eating out, entertainment, shopping |

| 💰 Savings & Investments | 20% | ₹4,000 | Emergency fund, SIPs, insurance |

✅ Detailed Expense Distribution

1. 🏠 Essentials – ₹10,000

These are must-have expenses for survival and basic functioning.

- Rent / PG / Hostel: ₹4,000–₹5,000 (shared accommodation or small unit)

- Groceries & Food: ₹2,500–₹3,000 (home-cooked, ration shopping)

- Electricity + Internet + Mobile: ₹800–₹1,000

- Transportation (Bus/Auto/Fuel): ₹500–₹1,000

- Other Essentials (Toiletries, etc.): ₹500

2. 🎉 Wants / Lifestyle – ₹6,000

Discretionary expenses for a better life balance.

- Eating Out / Snacks: ₹1,500–₹2,000

- Entertainment (OTT, movie, YouTube Premium, etc.): ₹500–₹700

- Clothing & Accessories: ₹1,000

- Gifts, occasional travel, events: ₹1,000–₹1,500

- Rechargeable items (books, digital tools, etc.): ₹500–₹1,000

3. 💰 Savings / Investments – ₹4,000

Your future depends on this. Start now, even if it seems small.

- Emergency Fund: ₹1,000 (in a high-interest savings account)

- Recurring Deposit / SIP (Mutual Funds): ₹1,000–₹2,000

- Health Insurance (basic plan or app-based): ₹500

- Digital Gold or PPF (optional): ₹500–₹1,000

📌 Tips to Maximize ₹20,000

- Cook at home 80% of the time to cut food costs.

- Use public transport or walk when possible.

- Avoid impulse purchases; use a 24-hour wait rule.

- Use UPI apps that offer cashback for small savings.

- Explore government schemes like PPF for tax-free savings.

Sample Monthly Planner (Visual View)

| Week | Spending Focus |

|---|---|

| Week 1 (Payday) | Rent + SIP setup + Grocery Stock |

| Week 2 | Food + Mobile/Data Recharge |

| Week 3 | Local Travel + Misc Essentials |

| Week 4 | Entertainment + Rollover Savings |

If You Want to Save More

- Cut “wants” by 10% and increase savings to 30%.

- Look for freelancing or side gigs for extra income.

- Buy groceries in bulk and share rent with roommates.